"My assessed value is what determines my property tax bill."

This is false!

"The assessed value is used to determine each property owners

portion of the overall Tax Burden."

This is correct!

What this means:

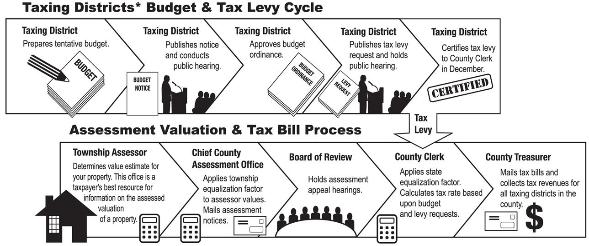

Municipalities, by state law, are guaranteed to receive the money they ask for as long as

it does not exceed the previous year's levy by 5% or the Cost of Living rate whichever is

lower. This is the reason Property Tax bills will not go down.

The total dollar amount that must be collected from property taxes will always be at least

as much as the previous year.

If all the assessed values decrease, the tax rate will increase and the overall

property tax bill will remain relatively the same.

This is a brief explanation for informational purposes only. For more detailed information please feel free

to contact our office